Key Points

- Spot gold eased 0.2% to $4,029.86 after touching a record high of $4,059.05 on Wednesday.

- Markets now price in a 93% chance of an October Fed rate cut and a 78% probability of another in December.

Gold retreated slightly on Thursday, falling 0.2% to $4,029.86 per ounce by 0642 GMT, after reaching an unprecedented $4,059.05 on Wednesday. The pullback came as investors booked profits following a record-setting rally driven by economic uncertainty, geopolitical risk, and expectations of further Federal Reserve rate cuts this year.

U.S. gold futures for December delivery slipped 0.6% to $4,047.80, while spot prices hovered near historic highs, holding comfortably above the $4,000 level.

Fed Policy and Market Sentiment

Minutes from the September 16–17 Fed meeting revealed that policymakers acknowledged growing risks to the U.S. labour market, signalling greater openness to monetary easing.

However, officials also noted lingering inflation concerns, tempering expectations for an aggressive rate-cut cycle.

Markets are now fully pricing in a 25-basis-point cut in October with a 93% probability, followed by another in December with a 78% likelihood, according to the CME FedWatch Tool.

The prospect of lower rates continues to bolster non-yielding assets such as gold, which tend to outperform in a softening policy environment.

Global Developments

Global tensions fuelled gold’s surge, though easing risks may have prompted the latest round of profit-taking. On Wednesday, Israel and Hamas agreed to the first phase of U.S. President Donald Trump’s Gaza plan. The ceasefire and hostage exchange deal could pave the way to ending a two-year conflict described by the U.N. as genocidal.

Key market analysts remain somewhat sceptical of the move. While the ceasefire removes one of the key drivers of safe-haven demand, “it’s probably just a handy excuse to take profits after hitting another record.”

Technical Analysis

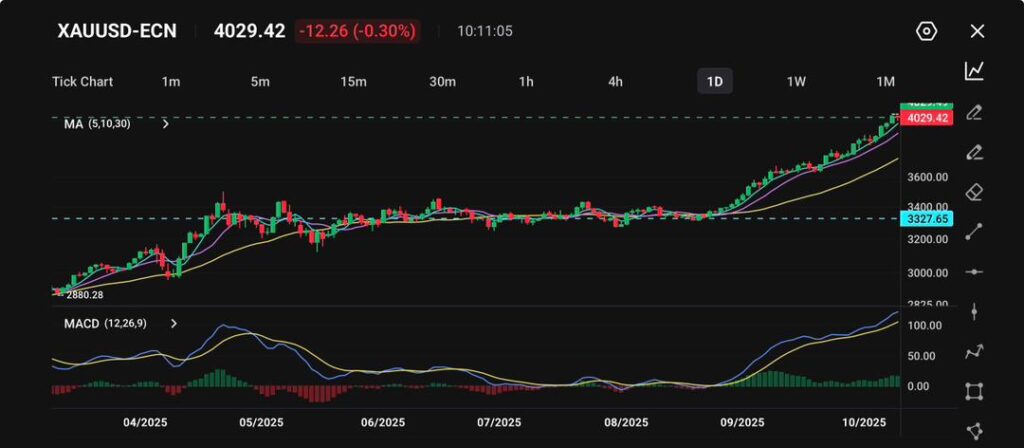

Gold (XAU/USD) is trading around $4,029.42, down 0.30% on the day after briefly touching fresh record highs earlier this week. The metal’s recent rally has shown signs of cooling, with traders locking in profits near the $4,050–$4,100 psychological resistance zone.

Despite this modest pullback, the broader bullish trend remains firmly intact, underpinned by ongoing macro uncertainty and sustained demand for safe-haven assets.

Technically, gold’s uptrend remains strong. Prices continue to trade above all major moving averages (5-, 10-, and 30-day MAs), reflecting sustained upward momentum even amid short-term corrections.

The MACD also remains deeply in bullish territory, though the histogram bars are beginning to shorten. Buying momentum may be losing steam as the market consolidates at elevated levels.

The immediate support zone lies near $3,950–$3,970, corresponding to minor swing lows formed earlier in the week. A deeper retracement could bring prices toward $3,850, aligning with the 10-day moving average.

Conversely, a decisive break above $4,100 would confirm a continuation of the bullish move, with upside potential extending toward $4,200–$4,250 in the medium term.

Cautious Forecast

Fundamentally, gold’s strength continues to be supported by a weaker U.S. dollar, moderating Treasury yields, and growing unease over the prolonged U.S. government shutdown.

With investors rotating into safe havens amid volatile risk sentiment, gold has maintained its appeal as a hedge against both political and economic instability.

Overall, while short-term consolidation appears likely after the sharp rally, the broader outlook for gold remains bullish. As long as gold holds above $3,950, dips are likely to attract renewed buying interest from both institutional and retail traders seeking to capitalise on safe-haven demand.