Key Points

- EUR/USD trades near $1.16, close to last week’s two-month low of $1.154.

- Markets await France’s draft budget amid renewed political uncertainty.

The euro hovered near $1.16 on Monday, holding close to its lowest level in over two months as traders monitored fresh political developments in France and subtle shifts in US-China trade relations.

France’s Budget Test

In France, political volatility continued after Prime Minister Sebastien Lecornu resigned last week, only to be swiftly reappointed on Friday.

Lecornu faces a significant test today as he presents a draft budget bill, navigating a tight parliamentary landscape where maintaining stability is crucial.

Lecornu is attempting to secure enough abstentions or conditional support from both the Socialists and centre-right Republicans to pass the budget. Encouragingly, most deputies have expressed opposition to dissolving parliament, suggesting a potential pathway for budget approval and avoiding a new round of elections.

US-China Dynamics

Meanwhile, geopolitical sentiment improved slightly after US President Donald Trump adopted a more conciliatory tone toward China, just days after threatening 100% tariffs on Chinese imports.

The softer rhetoric followed Beijing’s decision to tighten export controls on rare earth minerals, a move that had briefly escalated trade tensions.

The euro remains under modest pressure as traders favour the US dollar amid its safe-haven appeal and relatively stronger growth outlook. Market participants are also watching for cues from the European Central Bank (ECB), which has maintained a cautious tone on monetary policy, balancing inflation risks with signs of slowing activity.

Technical Analysis

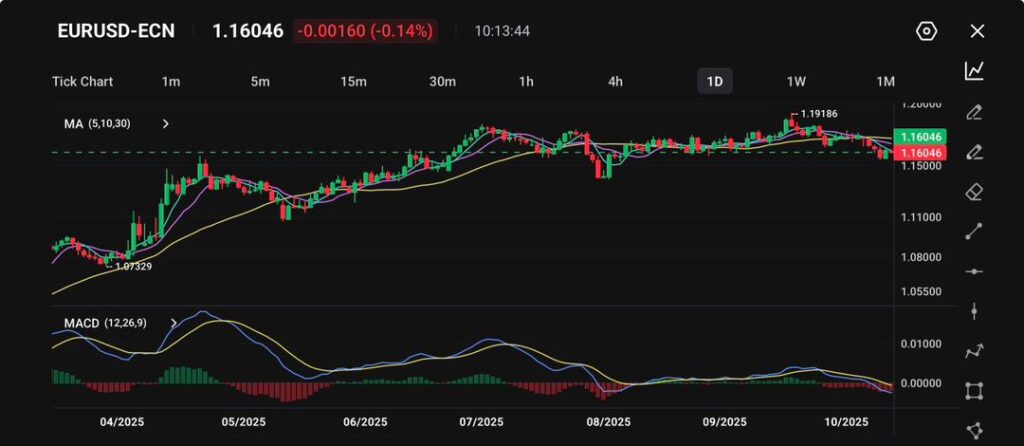

The EUR/USD pair is trading around 1.16046, slightly lower by 0.14%, as the euro continues to consolidate near its recent lows amid persistent dollar strength and mixed eurozone data. The pair remains under modest selling pressure, with traders weighing the European Central Bank’s cautious tone against the Federal Reserve’s commitment to keeping interest rates elevated for longer.

From a technical standpoint, EUR/USD has shifted into a mildly bearish posture. The pair has fallen below its 5- and 10-day moving averages, while the 30-day moving average is beginning to flatten, signalling potential loss of bullish momentum.

The recent rejection from the 1.1918 resistance level marks the formation of a short-term top, with price action now testing the key support area at 1.1550–1.1580. A clear break below this zone could open the path toward 1.1450, a level last seen in mid-summer 2025.

The MACD has turned bearish, with the signal line crossing above the MACD line and the histogram entering negative territory.

This momentum shift reinforces the likelihood of continued downside pressure in the near term unless the pair finds renewed buying interest around current levels.

On the fundamental side, the euro has been weighed down by weak manufacturing and industrial output data across the bloc, alongside political tensions in France and Italy that are dampening investor confidence.

Meanwhile, the U.S. dollar remains supported by safe-haven flows amid ongoing fiscal uncertainty in Washington and strong U.S. economic indicators, including retail sales and labour data.