Key Points

- Spot gold fell 1.28% to $4,072.72, retreating from record highs above $4,300.

- Traders booked profits after the metal’s 5% drop on Tuesday, its steepest since August 2020.

- Risk appetite improved as US–China trade tensions showed signs of easing.

Gold prices extended their decline on Wednesday, slipping below $4,100 per ounce as traders took profits following a record-breaking rally earlier in the week. The move reflected a broader shift toward risk assets amid renewed optimism that US–China trade negotiations may defuse tariff disputes.

The metal had already tumbled over 5% on Tuesday, marking its sharpest single-day loss in more than four years. Traders cited profit-taking and the unwinding of safe-haven positions as key drivers behind the correction.

Macro Backdrop

Optimism in financial markets rose after Presidents Donald Trump and Xi Jinping confirmed plans to meet next week to discuss trade policy, with both sides signalling willingness to stabilise relations.

The improved tone reduced demand for gold, which has surged this year on fears of economic slowdown and geopolitical instability.

Despite the correction, bullion remains up more than 60% year-to-date, underpinned by expectations of further Federal Reserve rate cuts, sustained central bank demand, and ongoing geopolitical risks.

Reports of tensions surrounding the delayed Trump–Putin summit, following Moscow’s refusal to agree to a Ukraine ceasefire, offered limited support to the metal.

Technical Analysis

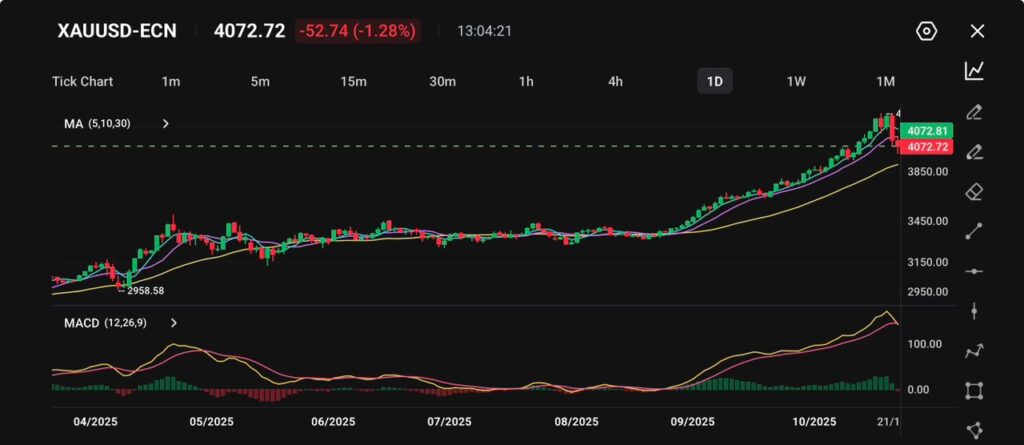

Gold (XAU/USD) fell to $4,072.72, down 1.28%, as traders booked profits after an extended rally that saw prices touch record highs earlier in the week.

The pullback comes amid a modest rebound in U.S. yields and the dollar, prompting some repositioning ahead of key U.S. macro releases later this week.

From a technical perspective, gold’s uptrend remains intact despite today’s correction. The metal has consistently held above its short-term moving averages, with the 5-day MA continuing to act as near-term dynamic support.

However, today’s bearish candle suggests waning momentum after weeks of near-vertical gains. The next downside level to watch lies around $4,020–$4,000, followed by a stronger support zone near $3,850, where the 30-day moving average aligns.

Resistance remains firm around the $4,100–$4,150 region, which capped the latest leg higher.

The MACD indicator still signals bullish momentum, but the widening gap between the MACD and signal lines appears to be peaking, hinting at potential exhaustion in the current rally.

If the histogram continues to contract, it may indicate a short-term retracement phase before any renewed upward push.

Outlook

Traders now await Friday’s U.S. CPI data for clues on the timing of future Fed rate cuts. Markets are currently pricing in two additional reductions by year-end, suggesting that the underlying case for gold remains constructive despite the near-term retracement.