Key Points

- WTI crude dropped 2.2% to $59.94, while Brent crude declined 2.1% to $63.52.

- OPEC+ may consider a modest output increase at its December meeting.

- Losses tempered by concerns over U.S. sanctions on Russian oil flows.

Crude oil prices fell sharply in early Tuesday trading as investors weighed the possibility of a global supply surplus against signs of progress in U.S.–China trade negotiations.

The initial optimism that had supported energy markets earlier this week faded as traders turned their attention to OPEC+ policy signals and the broader supply outlook.

Supply and Policy Outlook

Media reports suggested that OPEC+ could discuss a measured output hike for December, a move that would add to supply pressures at a time when demand growth remains uneven.

Analysts at ING noted that “the initial positive sentiment around U.S.–China trade talks faded as the oil market progressed through yesterday’s trading session,” as investors shifted focus to production decisions and sanctions impacts.

Still, downside momentum was partially contained by uncertainty surrounding U.S. sanctions on Russia’s largest oil producers, which have disrupted global supply flows and limited access to Western shipping and insurance.

The longer-term impact remains unclear, but markets expect some tightening in crude availability once sanctions fully take effect.

Technical Analysis

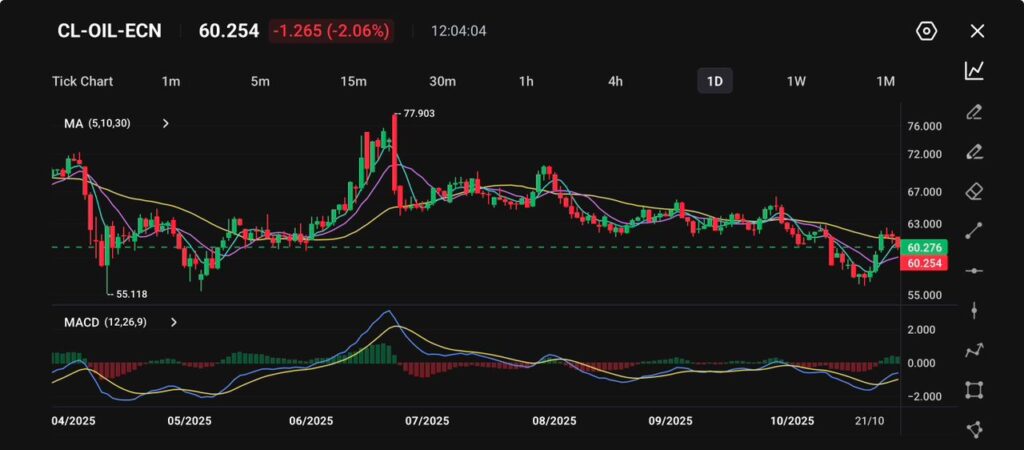

Crude oil (WTI) extended its pullback on Tuesday, slipping 2.06% to $60.25 as traders reassessed demand expectations amid mixed global data and rising inventory levels.

The decline snapped a brief recovery attempt seen earlier in the week, reinforcing concerns that the market remains vulnerable to economic softness and oversupply pressures heading into the year’s end.

From a technical standpoint, oil remains in a broad downtrend, with price action consistently capped by the 30-day moving average near $63.00.

Despite the recent bounce from October’s low of $55.11, the inability to sustain momentum above short-term resistance has kept the broader tone bearish.

Immediate support lies at $59.00–58.50, a zone that, if breached, could expose the next downside target around $55.00, a key historical floor from April.

The MACD indicator still reflects lingering weakness. While the histogram had briefly turned positive earlier this week, momentum has already started to fade, with the MACD line flattening below zero. This signals that buying interest remains limited and that the recent rally may have been corrective rather than the start of a new uptrend.

Cautious Outlook

Fundamentally, sentiment is weighed down by rising U.S. crude inventories and concerns that slower economic growth in Europe and China could cap fuel demand.

Meanwhile, OPEC+’s production discipline has so far failed to offset non-OPEC supply growth, particularly from the U.S. and Brazil, further undermining prices.

Overall, the trend bias remains bearish below $63.00, with the market likely to consolidate between $55.00 and $63.00 in the near term.

A decisive move above $63.00 would be required to signal a shift in momentum, while a break below $58.50 could accelerate downside pressure toward the $55.00 level once again.