Throughout 2025, precious metals have acted as the emotional barometer of the markets, reflecting global uncertainty, U.S. monetary policy shifts, and the trade pulse between the world’s two largest economies.

But in October 2025, that familiar narrative shifted.

From Euphoria to Adjustment: The Rally That Hit a Ceiling

At the start of the month, gold surged to a record high above $4,350 per ounce, fuelled by a potent mix of factors:

- Escalating trade tensions between the U.S. and China,

- Growing expectations of Fed rate cuts, and

- Heightened distrust toward sovereign currencies and public debt, driving what traders call the “devaluation trade.”

At the same time, silver prices climbed to unprecedented levels, reflecting both its safe-haven appeal and its sensitivity to the global industrial cycle. Images of buyers queueing outside bullion dealers went viral, while ETF inflows and retail demand surged to multi-year highs.

Yet by mid-October, cracks began to show. Technical indicators had warned since September that gold was deep in overbought territory. On 22 October, the market recorded its sharpest intraday drop in more than 12 years—a fall of up to 6.3%, followed by further losses that pushed prices down to $4,020 per ounce.

Analysts, including Suki Cooper of Standard Chartered, attributed the move to technical selling rather than a structural shift. Still, the message was clear: the gold rally needed to breathe.

The Epicentre: Washington, Beijing, and the Return of the Tariff Ghost

As metals corrected, the geopolitical narrative intensified.

On 10 October, the White House floated the idea of 100% tariffs on Chinese imports, responding to Beijing’s new export restrictions on rare earth metals. The announcement sent shockwaves across markets, reviving safe-haven flows.

Days later, President Donald Trump softened his tone, calling such tariffs “unsustainable in the long term.” The remark sparked brief relief and a pause in gold’s rally.

By 20 October, reports suggested quiet progress in U.S.–China negotiations. These culminated in an ASEAN summit (25–26 October) where both sides outlined a preliminary trade agreement—including a temporary tariff suspension and renewed Chinese agricultural purchases.

The reaction was swift: on 27 October, gold and silver fell 1.4% and 2%, respectively, as safe-haven demand receded. The market welcomed the thaw in trade tensions, but also recognised that the metals rally had entered a much-needed consolidation phase.

The Role of Monetary Policy and the U.S. Shutdown

Meanwhile, the United States faces a prolonged government shutdown, halting key data releases from the Bureau of Labor Statistics (BLS), including September’s NFP and unemployment reports.

The absence of fresh economic data has complicated the Federal Reserve’s policy outlook, leaving investors guessing. Some expect the U.S. dollar to weaken amid fiscal paralysis, while others anticipate a technical rebound once the shutdown ends.

In this vacuum, precious metals have become the market’s barometer, alternating between safe-haven inflows on uncertainty and profit-taking when risk sentiment briefly returns.

Market Outlook: Consolidation Before the Next Move

From my perspective, what we’re seeing in gold is not a trend reversal, but a necessary pause after a rally that simply moved too far, too fast. The market needed to breathe.

As long as expectations for Fed rate cuts remain intact and confidence in fiat currencies stays fragile, I believe gold retains a bullish medium-term outlook. The recent pullback toward the $4,000 level represents healthy consolidation rather than weakness, setting the stage for the next move higher once policy and sentiment align.

“The decisive driver in this phase is not just monetary policy, but the geopolitical narrative. Each step forward or backwards in U.S.–China trade discussions shifts investors’ appetite for safe-haven assets.”

In a world of persistent structural tension, precious metals continue to serve as strategic insurance, not merely financial instruments, but protection against global uncertainty.

Looking ahead, I expect the market to remain in consolidation mode over the coming weeks. If trade de-escalation holds and the Fed confirms its rate-cutting path, gold could stabilise around the $4,000 area before regaining upward momentum heading into 2026.

Technical Analysis

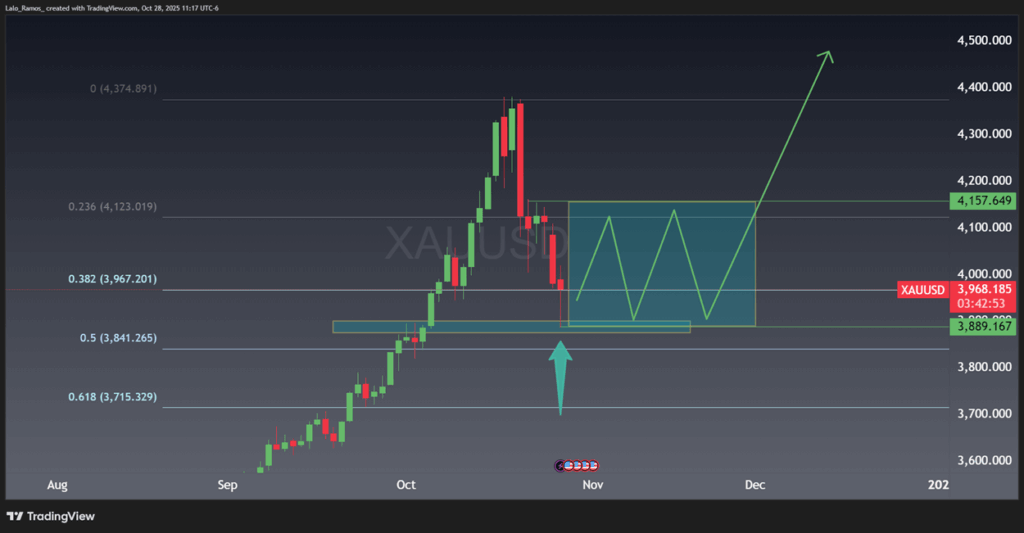

The XAUUSD pair rebounded from $3,890 per ounce, aligning closely with the 50% Fibonacci retracement level, just one day before the latest Fed policy decision. This suggests the level represents an attractive entry point (around 11% below its all-time high) for institutional investors.

From here, maintaining prices above $3,900 will be crucial. Gold may continue consolidating within a $3,890–$4,150 range into year-end, forming a sideways structure before its next breakout attempt.

Conclusion

Gold and silver close October with less short-term shine, but with solid medium-term fundamentals intact.

The recent correction marks a pause, not a reversal—a healthy reset after months of steep ascent.

If the U.S.–China trade détente holds and the Fed initiates a rate-cut cycle, metals could resume their upward trajectory before year-end.

For now, the market enters a phase of calm caution: less euphoria, more patience—but eyes still fixed on the next golden move.

Disclaimer:

The accompanying chart and commentary are provided for informational purposes only and should not be construed as financial advice or a solicitation to trade. Market conditions are subject to change, and past performance is not indicative of future results.