Key Points

- Nikkei 225 gained 1.51% to 52,332.65, extending its October rally to nearly 16%, the strongest monthly rise since 1994.

- Yen weakness continued to lift export-heavy stocks, while AI-related optimism bolstered sentiment.

- Global markets steadied as traders weighed the Fed’s policy path and a developing U.S.–China trade truce.

The Nikkei 225 Index continued its record-breaking advance on Friday, driven by sustained yen weakness and optimism over technology earnings and trade progress between the world’s two largest economies.

The benchmark closed up 780 points at 52,332.65, marking its eighth consecutive weekly gain and the most impressive monthly performance in over three decades.

Weak Yen and Central Bank Cues

The yen traded just below 154 per dollar, near its weakest level since February, offering a tailwind for Japan’s exporters and multinational corporations.

The currency’s slide followed dovish commentary from Bank of Japan Governor Kazuo Ueda, who held interest rates steady but hinted that any future hike would depend on wage and inflation data.

The sharp depreciation has renewed verbal intervention warnings from Tokyo officials but continues to underpin equity strength, particularly in automotive and industrial sectors.

Global Monetary Backdrop

The Federal Reserve’s recent rate cut helped shape global sentiment, although Chair Jerome Powell’s remarks that it could be the last cut of 2025 tempered expectations for additional easing.

The move strengthened the U.S. dollar and left traders uncertain about the policy path heading into 2026.

Meanwhile, market sentiment improved as U.S. President Donald Trump and Chinese President Xi Jinping reached a tentative trade truce, calming fears of escalation in tariffs and supply-chain disruptions.

Tech Earnings and AI Enthusiasm

Technology stocks extended their dominance, with Amazon leading global sentiment after posting its fastest cloud revenue growth in three years.

The upbeat results rippled through Asian markets, pushing Japan’s AI-related shares such as chipmaker Advantest, semiconductor giant Tokyo Electron, and SoftBank Group sharply higher.

Traders also looked ahead to Apple’s earnings, which are expected to further fuel optimism around consumer technology spending.

Technical Analysis

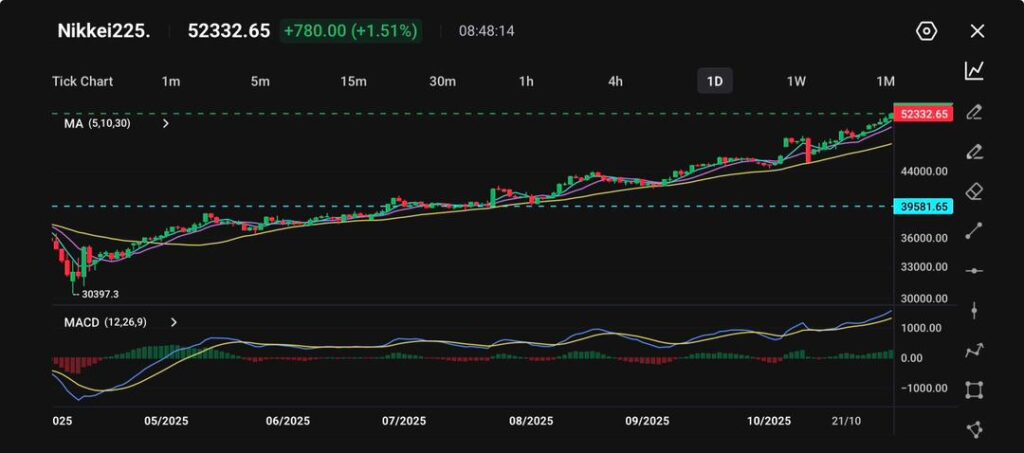

The Nikkei 225 surged to 52,332 points, gaining 1.51% as improved sentiment following the Trump–Xi meeting boosted risk appetite across Asian equities.

The reaffirmed commitment to stabilising U.S.–China trade relations and strengthening cooperation in tech and energy sectors lifted investor confidence, driving strong inflows into export-heavy Japanese stocks.

Technically, the index remains in a firm uptrend, extending its rebound from the October consolidation phase. The moving averages (5, 10, 30) are stacked bullishly, reflecting sustained momentum, while the MACD continues to widen in positive territory, confirming strong buying pressure.

With the Nikkei pushing decisively above the 50,000 psychological barrier, short-term resistance now lies near 52,500, while support is seen around 49,000.

Overall, the outlook remains constructively bullish, with Japan benefiting from renewed regional optimism, a weaker yen aiding exports, and improving external trade sentiment spurred by the thaw in U.S.–China ties.

Outlook

Japan’s equity outlook remains favourable heading into November, with sentiment buoyed by the weak yen, upbeat earnings, and improving trade prospects. However, the market’s pace of ascent may trigger bouts of profit-taking, particularly if intervention fears in the currency market grow louder.

Overall, traders appear to be embracing the so-called “Takaichi trade”, betting that Japan’s pro-stimulus government and global AI enthusiasm will continue to fuel the Nikkei’s upward momentum.