Key Points

- WTI crude dipped 0.16% to $60.89, while Brent fell 0.3% to $64.71.

- IEA and SocGen analysts warn of a potential 4 million barrels/day surplus by 2026.

- Rising output from OPEC+, the U.S., Canada, and Guyana adds pressure on prices.

Crude oil futures fell slightly on Tuesday, extending recent weakness as market participants focused on projections of rising global supply.

The International Energy Agency (IEA) warned that continued production increases from major producers including OPEC+, the United States, Canada, and Guyana could lead to a significant surplus of roughly 4 million barrels per day by 2026.

According to a note from Société Générale’s cross-asset research team, the expected demand increase of 900,000 barrels per day will not be sufficient to offset the expanding output, even with China’s oil purchases of around 500,000 barrels per day providing partial support.

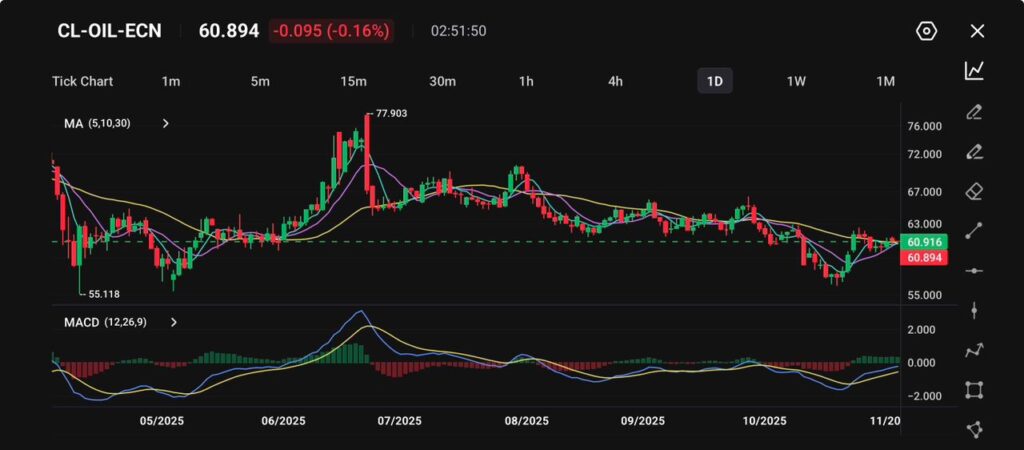

Technical Analysis

Over the short term, prices are hovering around $60.89 with only a modest 0.16% drop, highlighting some consolidation after a slide from higher levels.

The moving averages (5, 10, 30-day) appear to be flattening, suggesting that the downtrend may be pausing or slowing rather than rapidly reversing.

Support can be seen near the $59.00-$58.50 range, where the price previously bounced; resistance is around the $63.00 level, where price has been capped. The MACD line remains below the signal line, indicating momentum is still bearish or, at best, neutral.

From a broader perspective, the oil market is facing conflicting signals. On one hand, the recently announced OPEC+ decision to pause output increases in Q1 2026 provides some support, as it signals supply restraint.

On the other hand, weaker manufacturing data in Asia and forecasts of ample global supply and subdued demand are weighing on prices. This tug of war is contributing to the current sideways/weak structure in the chart.

Outlook

Despite ongoing geopolitical uncertainty, the near-term balance appears tilted toward oversupply. Traders will closely monitor OPEC+ meeting commentary and upcoming U.S. inventory data for clues on production discipline and consumption trends.

Without signs of demand acceleration or coordinated output restraint, crude prices may struggle to hold above $60 in the coming weeks.