Key Points

- Spot gold rose 0.4% to $3,942.97, while December futures eased 1.1% to $3,955.

- The Fed cut rates by 25 basis points to a target range of 3.75%–4.00%.

- Dollar index slipped 0.2%, supporting gold’s short-term rebound.

Gold prices rose modestly on Thursday after the Federal Reserve cut interest rates by a quarter percentage point for the second time this year, reinforcing the appeal of safe-haven metals.

A weaker U.S. dollar also contributed to the uptick, while traders continued to monitor the upcoming Trump–Xi meeting in South Korea for trade developments.

Fed Policy and Dollar Moves

The Fed’s decision to reduce the benchmark rate to 3.75%–4.00% aligned with market expectations.

Chair Jerome Powell signalled a divided outlook among policymakers, warning markets not to assume further cuts this year. The tone was less dovish than anticipated, tempering gold’s initial surge.

Still, the U.S. dollar index (USDX) fell 0.2% after hitting a two-week high on Wednesday, easing pressure on bullion and making it more affordable for holders of other currencies.

Analysts noted that the dollar’s retreat helped offset the impact of Powell’s cautious tone, allowing gold to stabilise above the $3,940 level.

Global and Trade Factors

Attention has now shifted to the Trump–Xi summit, with markets hoping for a temporary truce in the ongoing trade dispute.

Meanwhile, U.S. President Donald Trump finalised details of a new trade deal with South Korea’s President Lee Jae Myung, further shaping the region’s diplomatic landscape.

However, tensions between Washington and Beijing remain, with longer-term trade frictions and technology controls expected to persist beyond any near-term agreement.

Technical Analysis

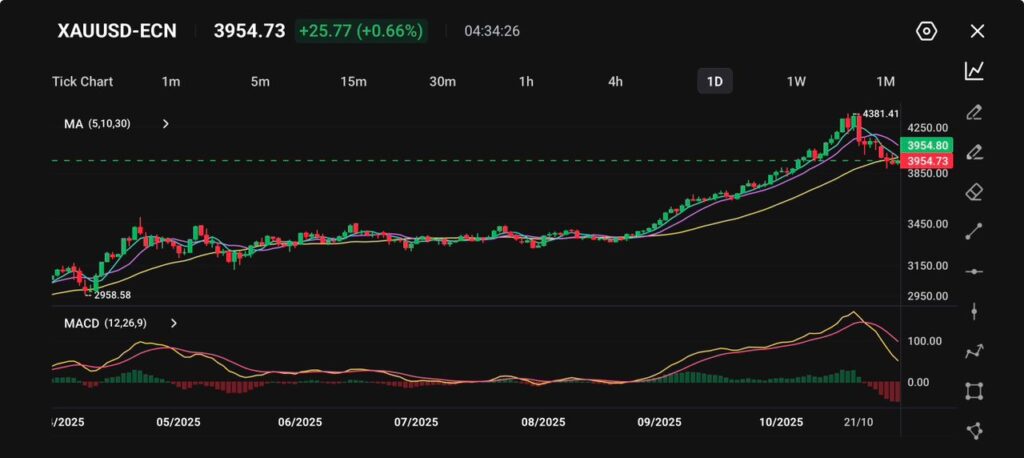

Gold (XAU/USD) edged higher by 0.66% to $3,954.73, stabilising after a sharp two-day sell-off that saw prices retreat from record highs above $4,380. The rebound reflects cautious bargain-hunting as traders weigh shifting expectations around U.S. monetary policy and persistent global risks that continue to underpin safe-haven demand.

From a technical perspective, gold is attempting to reclaim its footing above the $3,950 level after finding near-term support around $3,850, aligning closely with the 30-day moving average.

This zone now acts as a critical pivot point: holding above it could allow for a recovery toward $4,050–4,100, while a sustained break below may trigger a deeper retracement toward $3,800.

Despite the recent pullback, the broader uptrend remains intact. The moving averages (5, 10, and 30) are still aligned in a bullish configuration, though short-term momentum has cooled.

The MACD indicator confirms this moderation, with the MACD line now below the signal line and the histogram showing waning bearish pressure, suggesting that sellers are losing momentum and that consolidation could precede a new directional move.

Fundamentally, the outlook remains mixed. While stronger U.S. data has tempered bets on aggressive rate cuts, safe-haven flows remain resilient amid global uncertainty and slowing global growth signals.

The Fed’s upcoming policy remarks will be key in determining whether the recent correction deepens or if gold resumes its longer-term bullish trajectory.

Outlook

While gold remains underpinned by a lower-rate environment, near-term direction will hinge on the Trump–Xi meeting and upcoming U.S. employment data. Traders expect volatility to persist as markets weigh monetary easing against potential trade progress.

Despite recent outflows from the SPDR Gold Trust, bullion’s long-term outlook remains supported by sluggish growth, persistent inflation, and central bank diversification.