Key Points

- WTI crude rose 1.09% to $58.17, while Brent climbed 1.7% to $62.38.

- The U.S. Energy Department plans to purchase up to 3 million barrels for December and January delivery.

Crude oil prices climbed in early trade on Wednesday, supported by news that the U.S. Energy Department intends to partially refill its Strategic Petroleum Reserve (SPR) after months of drawdowns.

The move comes as Washington looks to rebuild its emergency stockpiles, which currently stand around 60% full, following large-scale releases over the past two years aimed at curbing fuel inflation.

According to ANZ Research, the government’s proposed purchases for December and January delivery could total around 3 million barrels, based on current prices. The decision provided a floor for prices that had been under pressure amid worries about slowing demand and growing output from OPEC+ producers.

Technical Analysis

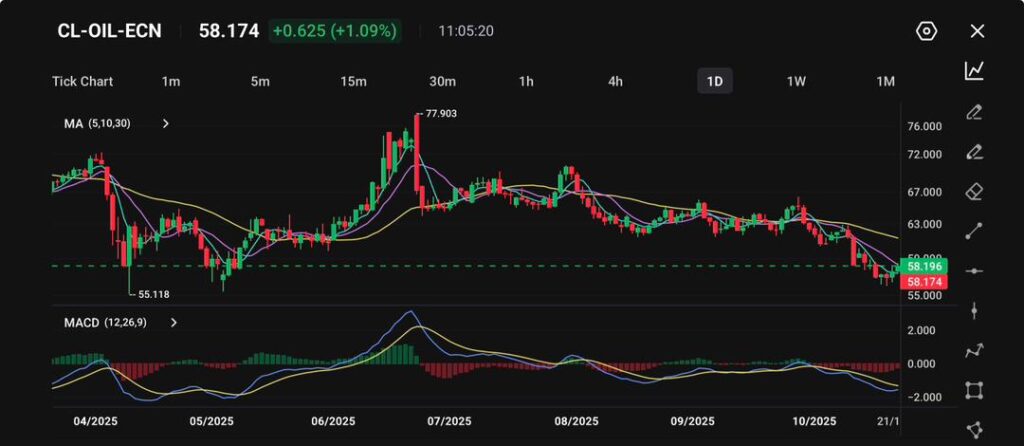

Crude oil prices (CL-OIL) edged higher to $58.17, up 1.09%, as buyers cautiously stepped in after the recent slide toward multi-month lows.

The rebound reflects short-covering and technical buying near the $55.00 support zone, though overall sentiment remains fragile amid concerns over slowing global demand and resilient supply levels from OPEC+ producers.

From a technical standpoint, the chart shows a modest recovery from oversold conditions. The price has bounced off a critical support line near $55.10, which aligns with the previous trough seen in May.

However, oil remains capped below its 10-day and 30-day moving averages, suggesting that the broader trend remains bearish until a stronger recovery confirms a reversal.

Key resistance sits near $60.00–$62.50, where multiple moving averages converge and previous breakdowns occurred.

The MACD indicator continues to display bearish bias but with early signs of potential stabilisation. The histogram is narrowing, and the MACD and signal lines are beginning to flatten out, hinting at possible consolidation before a clearer directional move.

For bulls, a sustained close above $60.00 could open the door toward $63.00, while failure to hold above $57.00 may invite renewed selling pressure toward $55.00 or even $52.00.

Fundamentally, oil remains under pressure due to persistent economic uncertainty in China and Europe, which continues to dampen energy demand forecasts.

Meanwhile, U.S. inventory builds and resilient production have capped upside momentum. That said, any signs of OPEC+ intervention or global flare-ups could temporarily support prices in the short term.

Outlook

While the U.S. SPR refill plan has lifted near-term sentiment, the broader oil market still faces headwinds from ample global inventories and sluggish consumption growth. Traders are expected to monitor the upcoming EIA inventory report and OPEC+ output data for further direction.