Key Points

- Dollar Index drops to 99.674, reversing monthly gains as traders price a 70% chance of a Fed cut by 10 December.

- Private surveys show job losses in retail and government sectors, while Challenger data points to a rise in U.S. layoffs.

The Dollar Index (USDX) extended its retreat to 99.674, erasing earlier gains after private labour surveys suggested rising job losses during the ongoing U.S. government shutdown.

The move reflects trader caution amid a lack of official employment data, as the non-farm payrolls report remains postponed.

Traders turned to alternative indicators for guidance. Challenger data revealed a spike in U.S. job cuts, particularly in government and retail, while reports noted increased corporate layoffs linked to automation and cost optimisation.

The shift in sentiment saw the USDX shed 0.5%, its steepest daily drop in three weeks, after briefly testing above the 100.00 level earlier in the week.

Fed Policy Expectations Rise Amid Data Gaps

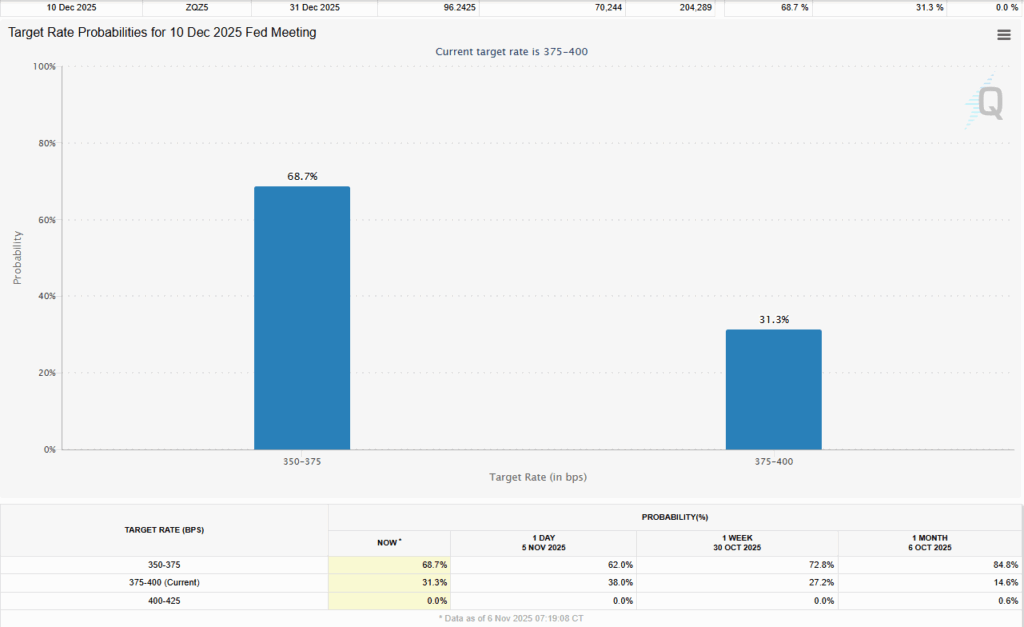

Market pricing now implies a near-70% probability of a Fed rate cut at the December 10 meeting, up from 62% just a day earlier, according to the CME FedWatch Tool.

The surge in rate expectations came despite Chicago Fed President Austan Goolsbee’s remarks that the absence of inflation and labour data “accentuates” the need for caution.

The lack of official releases during the shutdown has introduced an unusual layer of uncertainty for policymakers. Traders are increasingly focused on the upcoming personal consumption expenditures (PCE) report once data flow resumes, viewing it as critical for validating the Fed’s easing trajectory.

Technical Analysis

The dollar index currently sits around 99.63, having strengthened slightly but remaining below the psychological 100 mark.

On short-term (15-minute) chart chops, the 5-, 10-, and 30-period moving averages show a modest up-tilt, while the MACD has turned positive, signaling that short-term momentum is improving albeit from a low base.

Against this backdrop, recent macro news provides context: private sector data indicate job losses in October and rising lay-offs, raising speculation that a rate cut by the Federal Reserve in December is now more likely.

Carrying this into the technical picture: if the index fails to break and hold above ~100.00–100.20, it risks a pull-back toward 99.10–99.50.

Stay up-to-date on the latest chart movements by downloading the VT Markets app.

Conversely, if it pushes through 100.00 with conviction, next targets might sit around 100.70–101.00.

In short, the bias is mildly bullish until or unless macro surprises lean the other way. The main pivot to watch is the 100.00 level. A breakout above this could herald stronger dollar strength, while rejection may lead to a short-term consolidation or retracement.

Cautious Forecast

If U.S. data continues to point toward weakening employment conditions, the Dollar Index may remain pressured below the 100.00 threshold. A sustained move under 99.40 could expose 98.90, while recovery above 99.80 may draw profit-taking from short positions.

With uncertainty surrounding the government shutdown and limited macro releases, traders are likely to maintain a defensive stance, using short-term rallies to adjust exposure until clearer labour and inflation signals emerge.