Overview

- Fed remains split on a December rate cut as key inflation and labour data remain delayed.

- Traders brace for US CPI and NFP releases this week, pending shutdown recovery.

- Risk assets look to stabilise after tech-led volatility and profit-taking.

A late-2025 government shutdown has triggered a data vacuum, with many key indicators either delayed or unlikely to be published before the December 10–11 Fed meeting.

Only the September CPI report has been released. The October non-farm payroll (NFP) report could be delayed into December, and PCE inflation data may not meet release standards in time.

This has forced policymakers to operate with partial visibility. Several Fed members have flagged this as a reason to proceed cautiously, with Atlanta Fed’s Bostic noting that decisions may have to be made without complete data.

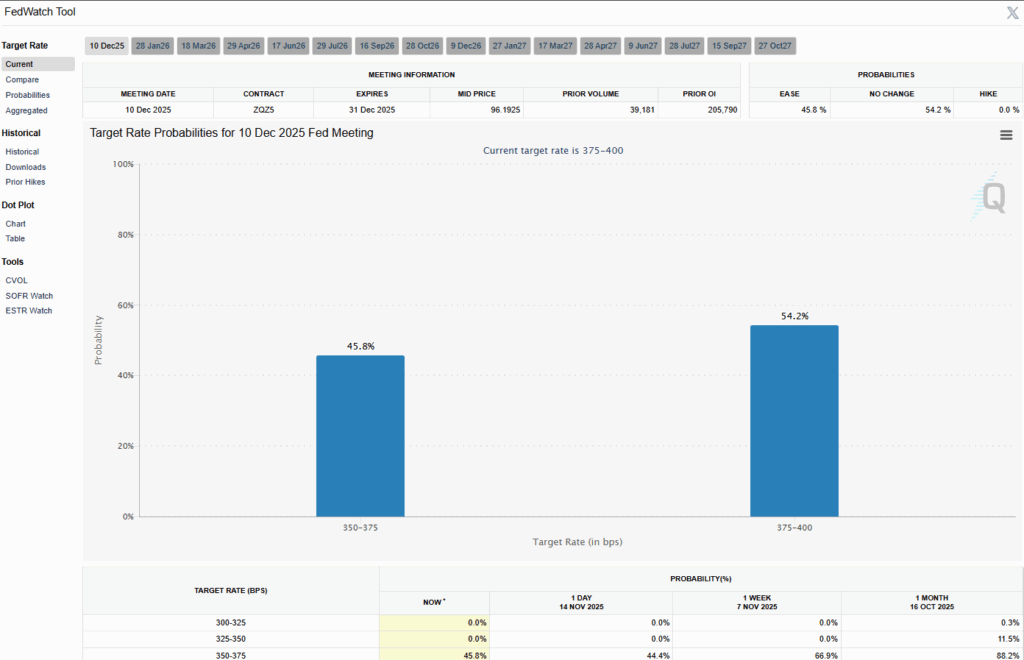

As of 16 November, CME FedWatch Tool places the odds of a 25 bp cut at the December meeting around 44.4%, down from 63% earlier this month and from 85–90% pre–October FOMC. The drop in expectations reflects growing caution among policymakers.

Some members, like Waller and Bowman, have argued for a proactive cut based on labour softening. Others, including Jefferson and Schmid, have called for restraint given persistent inflation.

The Fed’s internal divide underscores the risk of a policy surprise either way.

Market Reaction May Be Binary

Markets are now weighing two potential outcomes for the December FOMC meeting. If the Fed opts to cut rates, risk assets such as equities, gold, and cryptocurrencies could benefit, while the US dollar may come under pressure.

The scheduled end of quantitative tightening on 1 December would add to the liquidity boost. On the other hand, if the Fed holds rates steady, market sentiment may turn defensive.

A stronger dollar could weigh on gold and Bitcoin, and equities may struggle if traders push back expectations for easing into 2026.

Meanwhile, Russia’s Novorossiysk port has resumed crude exports after a two-day shutdown, easing supply fears and pulling WTI back toward the $59 range. For traders, the quick swing from disruption to recovery highlights a classic volatility window, where fast-moving supply headlines can create short-term opportunities in oil and energy-linked markets.

Overall, this week’s incoming data, particularly Thursday’s US employment figures, could act as a catalyst in either direction depending on how they land relative to expectations.

Key Symbols To Watch

Upcoming Events

| Date | Currency | Event | Forecast | Previous | Analyst Remarks |

| 17 Nov (Mon) | CAD | CPI m/m | 0.20% | 0.10% | If USDCAD moves higher early in the week, this release could drag it lower. |

| 19 Nov (Wed) | GBP | CPI y/y | 3.60% | 3.80% | A soft print reinforces cooling inflation narrative; watch for movement in GBPUSD. |

| 20 Nov (Thu) | USD | Non-Farm Employment Change | – | 22K | Labour market update carries weight in absence of full data post-shutdown. |

| 20 Nov (Thu) | USD | Unemployment Rate | – | 4.30% | Unclear if October figures will be released; any new data could sway Fed outlook. |

Key Movements of the Week

Gold (XAUUSD)

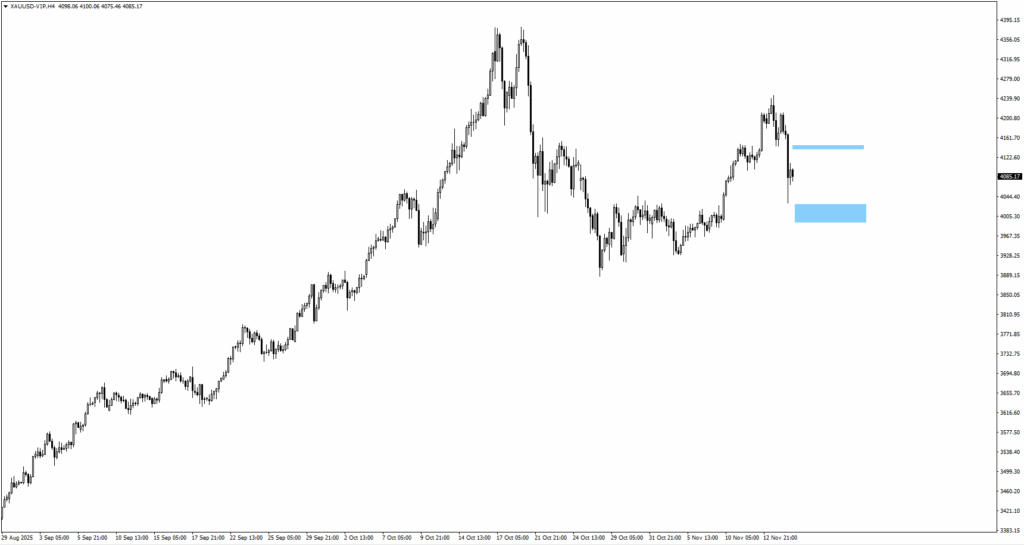

- Price currently consolidates near $4,085 after a steep drop from recent highs around $4,260.

- If price retests and rejects near $4,160–4,170, downside continuation remains in play.

- Key support sits at $4,005–4,045; bullish setups may emerge from this zone if momentum holds.

- Break below $4,000 could expose deeper retracements; a reclaim of $4,170 reopens upside potential.

Bitcoin (BTCUSD)

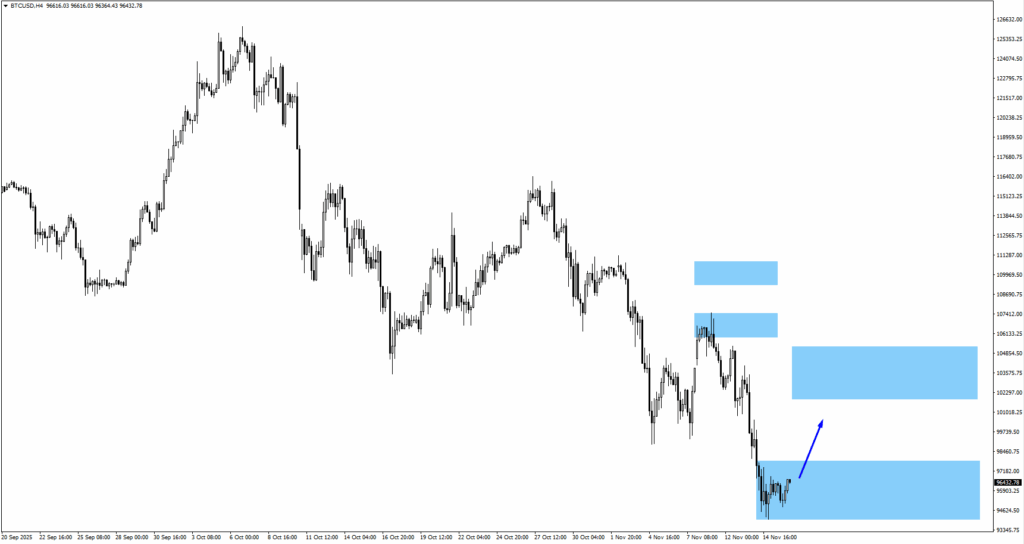

- Bitcoin is trading around the $96,850 monitored zone; bulls lack momentum without liquidity tailwinds.

- A move toward $102,000 or $104,500 could follow if rate cut odds rebound.

- Downside risk grows if US macro surprises on the hawkish side.

S&P 500 (SP500)

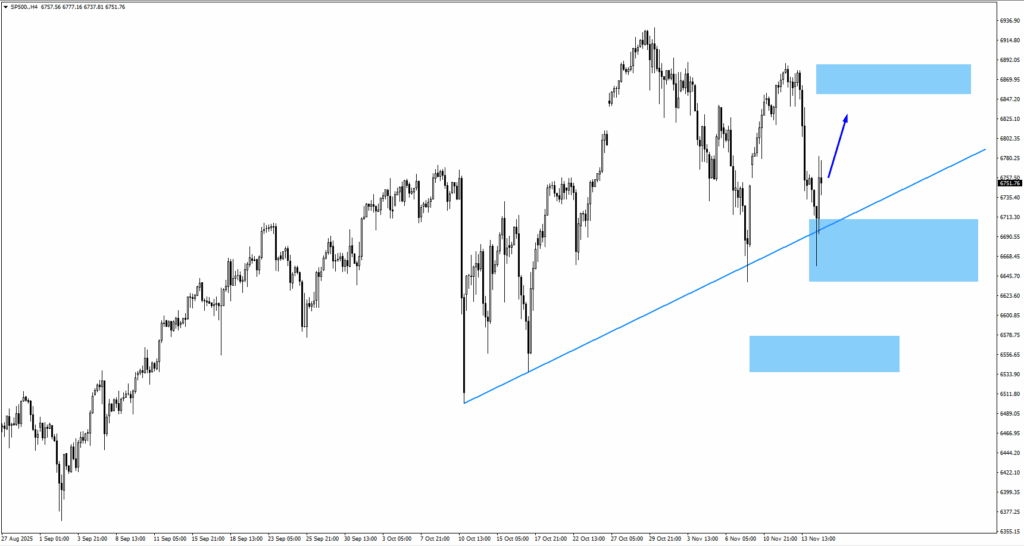

- SP500 is holding support around 6,665 but remains range-bound.

- If price consolidates, a retest of 6,865 may follow; a break lower would signal deeper correction.

- Fed outlook and macro data will dictate broader equity sentiment this week.

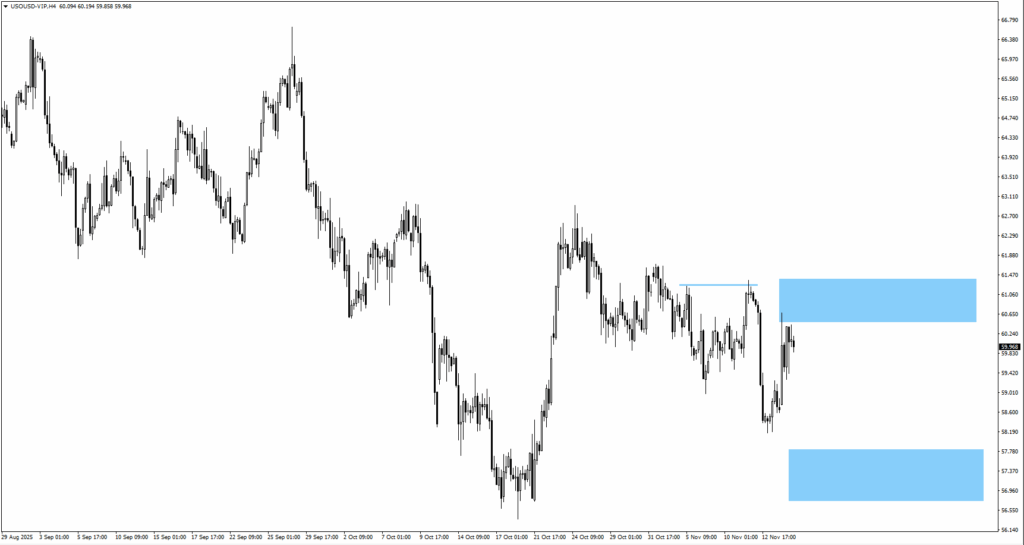

USOil

- USOil was trading around 60.45 last week, but quickly fell to around 59.5 per barrel on Monday, paring gains from the previous session after Russia’s Novorossiysk port resume oil loading operations.

- If momentum turns lower, the next key support to watch is around 57.80, where buyers previously stepped in.

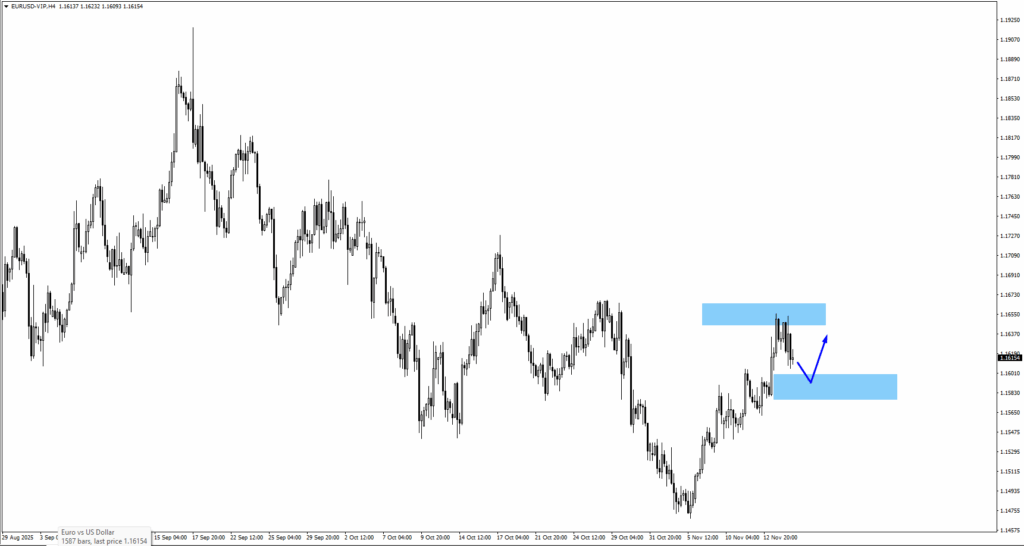

EURUSD

- EURUSD dipped from the 1.1650 area; bullish structure now monitored at 1.1590.

- A break below 1.1555 would invalidate the upside zone.

- Price action hinges on US inflation data and ECB tone.

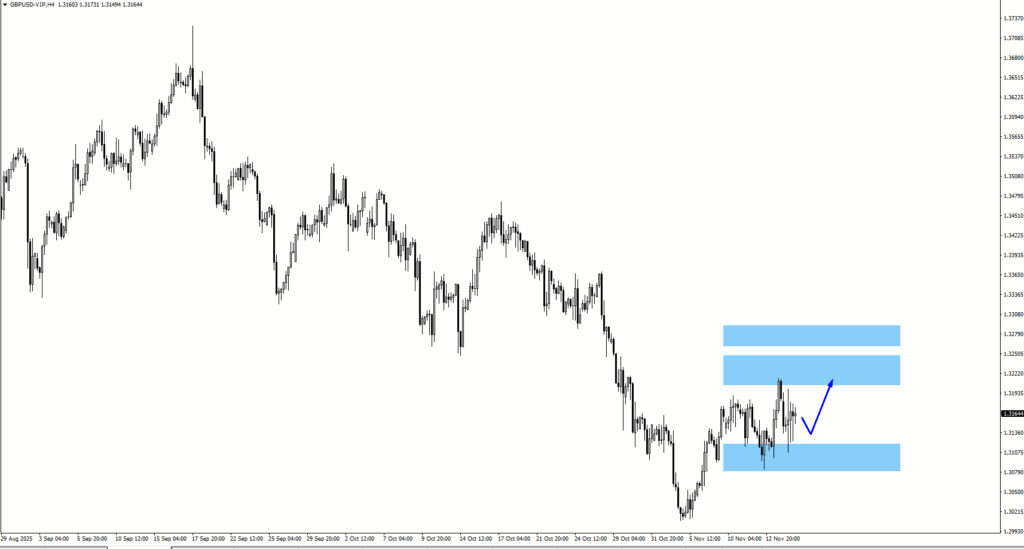

GBPUSD

- Cable pulled back from the 1.3225 zone and may revisit 1.3100 before the next leg higher.

- Traders eye price response near 1.3275 on a rally.

- CPI figures on Wednesday are key for next directional leg.

Market Snapshot

The Federal Reserve approaches its December meeting with a divided stance and limited data visibility, making the policy outlook uncertain. Traders remain highly reactive to incoming macro headlines, particularly around employment and inflation.

With CPI, NFP, and the Fed minutes all on deck, these events will play a key role in shaping market expectations as year-end approaches.