Overview

- Fed and BOJ policy meetings dominate this week’s macro calendar.

- Traders watch for signs of divergence in global rate paths.

- US Core PCE and Japan’s inflation trends may guide near-term dollar direction.

- Key focus: Gold, USDJPY, and US indices amid cross-currency and yield pressure.

Markets open the week on cautious footing ahead of a heavy central-bank lineup that includes the Federal Reserve, Bank of Japan, and European Central Bank. The dollar index (USDX) remains near 98.80 after retreating from 99.28, while gold hovers around USD 4,190 following a corrective pullback.

The upcoming days could see sharp repricing if the Fed delivers a widely anticipated 25–50 bps cut and the BOJ signals a December lift-off. Equity traders are also eyeing mega-cap earnings from Apple, Microsoft, Alphabet, Meta, and Amazon, which could sway broader sentiment.

Central Banks in Focus

Federal Reserve: Policy Pivot in Sight

Markets currently price a 25 bps Fed rate cut at the October meeting, with a smaller probability of a deeper 50 bps move. The Advance GDP report (forecast 3.0% q/q vs 3.8% prior) and Core PCE (expected 0.2% m/m) will test whether the Fed’s easing narrative remains justified.

A dovish Fed cut could weaken the dollar further, lifting gold and risk assets, though traders may stay cautious until Chair Powell’s post-meeting guidance clarifies the pace of future easing.

Bank of Japan: December Hike Base Case

Japan’s inflation remains above the 2% target, with September core CPI at 2.9% y/y and October services PMI at 52.4, underscoring resilient domestic demand. However, weak manufacturing data (PMI at 48.3) supports a cautious approach. Markets largely expect a “hawkish hold” this week, with the first rate hike (to 0.75%) now seen as more likely in December.

This divergence of Fed cutting while BOJ tightens later could narrow the USDJPY rate gap and pressure the pair lower into year-end.

Key Symbols to Watch

XAUUSD | USDJPY | SP500 | USOIL | USDX

Upcoming Events

| Date | Currency | Event | Forecast | Previous | Analyst Remarks |

| 27 Oct | AUD | RBA Gov Bullock Speaks | — | — | Watch tone for policy bias amid inflation pressures. |

| 29 Oct | AUD | CPI y/y | 3.10% | 3.00% | A hot print could extend AUD gains ahead of the Nov meeting. |

| 29 Oct | CAD | Overnight Rate | 2.25% | 2.50% | BoC likely to pause; focus on forward guidance. |

| 30 Oct | USD | Federal Funds Rate | 4.00% | 4.25% | 25–50 bps cut expected; tone will steer USD reaction. |

| 30 Oct | JPY | BOJ Policy Rate | 0.50% | 0.50% | Hawkish hold expected; watch for December hints. |

| 30 Oct | USD | Advance GDP q/q | 3.00% | 3.80% | Growth cooling could validate Fed easing bias. |

| 30 Oct | EUR | Main Refinancing Rate | 2.15% | 2.15% | ECB on hold; focus on inflation commentary. |

| 31 Oct | USD | Core PCE Price Index m/m | 0.20% | 0.20% | Key inflation gauge for Fed trajectory. |

Key Movements of the Week

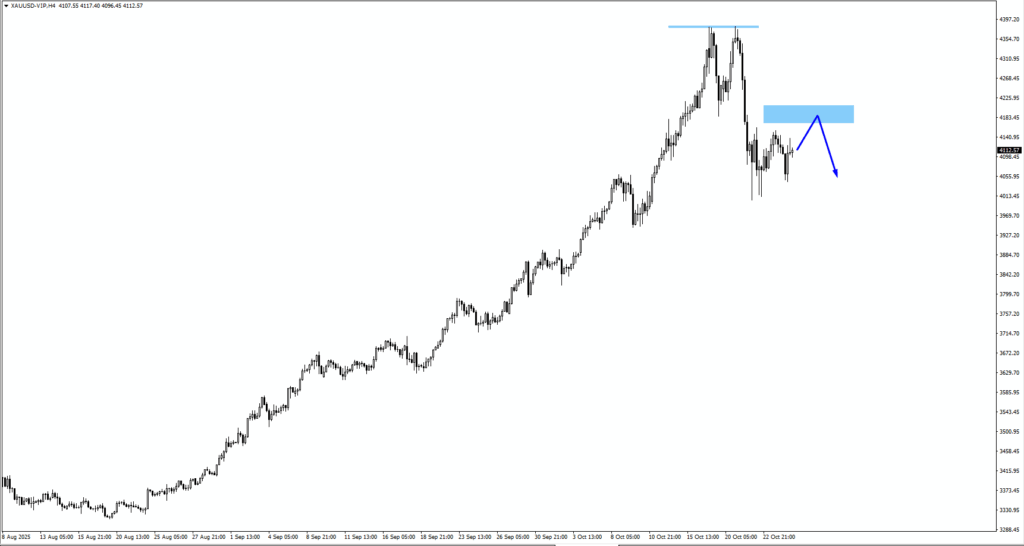

Gold (XAUUSD)

- Gold retreated after testing USD 4,190 resistance.

- A move above USD 4,200 could reopen gains toward USD 4,275.

- Support lies near USD 4,000; watch PCE data for direction.

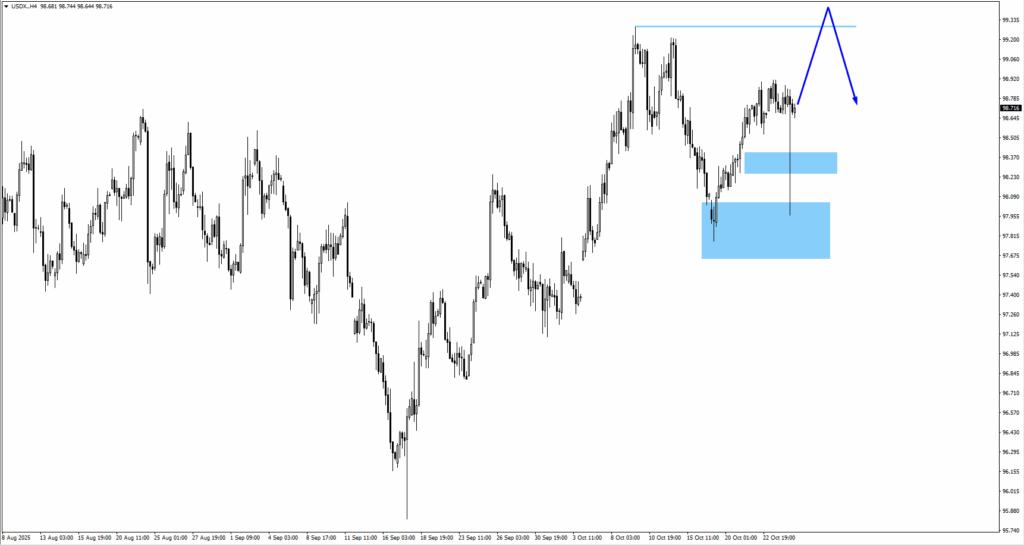

US Dollar Index (USDX)

- Currently around 98.80, facing resistance at 99.28 and 99.80.

- A dovish Fed cut could push USDX below 98.50.

- A surprise 25 bps cut or cautious tone may stabilise it above 99.00.

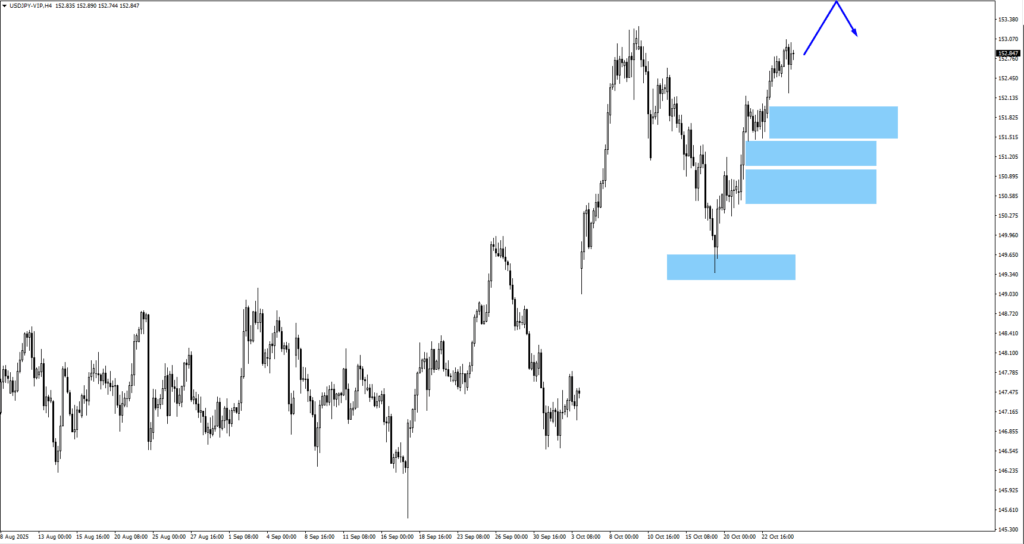

USDJPY

- Trading above 153.20; a hawkish BOJ could drive the pair lower toward 151.80.

- If the Fed cuts aggressively, downside pressure could intensify.

- Resistance seen near 153.80–154.00 if BOJ holds steady.

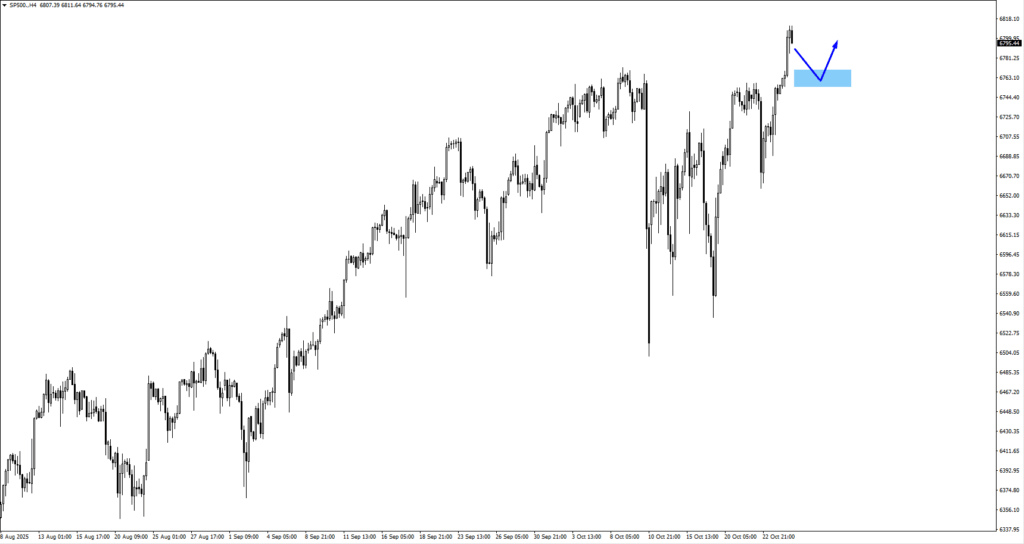

SP500

- Printed new highs; immediate support at 6,750.

- Earnings from big tech will guide sentiment.

- Sustained breakout above 6,800 keeps the uptrend intact.

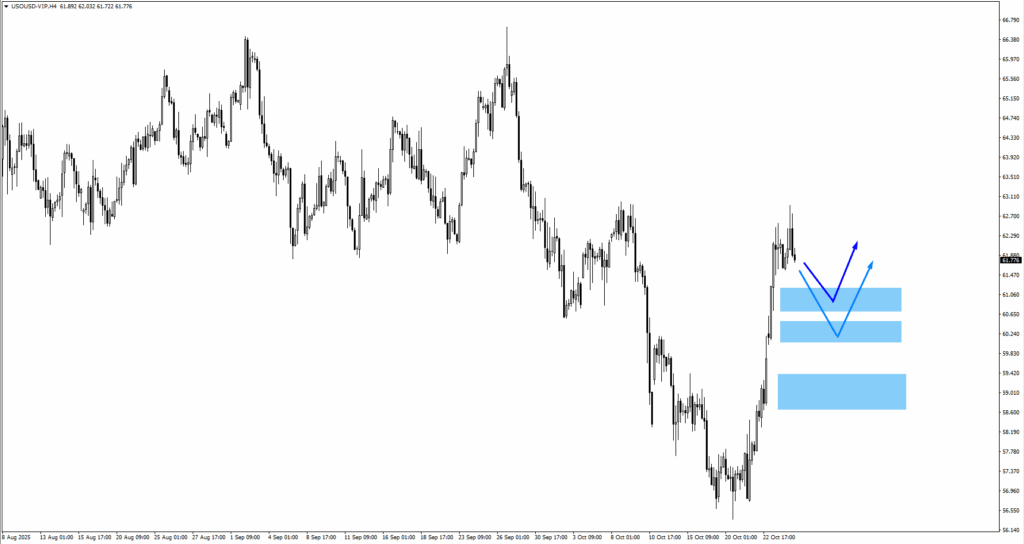

USOil

- Consolidating near USD 61.00–60.30 support zone.

- A break above USD 62.50 could target USD 65.00.

- Demand concerns remain tied to global growth data.

Bottom Line

- Markets brace for the Fed and BOJ decisions that could reshape cross-currency trends.

- Gold and yen remain sensitive to yield differentials and inflation signals.

- Tech earnings and US PCE data are key catalysts for volatility this week.