Overview

- S&P 500 earnings momentum continues to drive sentiment as inflation data approaches.

- Traders should watch for reactions to US CPI and PPI, alongside UK GDP data.

- Q3 profit growth remains strong, but high valuations mean limited room for error.

- Focus asset: S&P 500 index, with tech and financials leading market direction.

The S&P 500’s four-quarter profit streak has kept bulls in charge, but upcoming CPI data could decide whether that momentum still holds.

Nearly all S&P 500 companies have now reported Q3 results, with earnings up about 13.1% year on year; far above the 7.9% forecasted earlier in the year.

Around 82% of firms beat EPS estimates, marking the fourth consecutive quarter of double-digit profit growth.

Technology and financial sectors led the gains, each posting over 20% earnings growth thanks to strong AI spending, solid fee income, and disciplined cost management.

Industrials and utilities followed closely with double-digit growth, while healthcare and discretionary sectors delivered more modest single-digit increases.

However, forecasts for Q4 show a slowdown, with earnings growth expected to ease to around 7–8%, while revenue expansion moderates near 7.1%. Analysts project 11.6% full-year EPS growth for 2025, but a softer end-of-year pace reflects cautious guidance.

About 58% of companies issuing Q4 guidance have trimmed expectations, in line with historical trends.

Valuations Stretch as Risks Build

The S&P 500’s forward P/E sits near 22.7, above the five-year average of 20. This premium reflects optimism that strong margins will persist, yet with profit margins already near post-pandemic highs of 13%, room for further expansion is limited.

If inflation data this week shows persistence above the 3% annual rate, traders may reassess the timeline for Fed policy easing, potentially pressuring valuations. Conversely, a softer CPI could bolster risk appetite and extend gains in technology and cyclical names.

Key Symbols to Watch

SP500 | NAS100 | XAUUSD | GBPUSD | USDX

Upcoming Events

| Date | Currency | Event | Forecast | Previous | Analyst Remarks |

| 13 Nov (Thu) | GBP | GDP m/m | 0.00% | 0.10% | Markets watching for signs of stagnation in UK growth after Q3 softness. Any contraction could pressure GBP. |

| 13 Nov (Thu) | USD | CPI y/y | — | 3.00% | Inflation remains in focus for Fed policy outlook. A softer print could reinforce rate-cut expectations. |

| 14 Nov (Fri) | USD | PPI m/m | — | — | Tentative release; traders watching for producer-cost trends feeding into consumer inflation. |

| Next Week (19 Nov Wed) | GBP | CPI y/y | — | — | Inflation remains key to Bank of England policy; elevated readings may dampen rate-cut bets. |

For full view of upcoming economic events, check out VT Markets’ Economic Calendar.

Key Movements of the Week

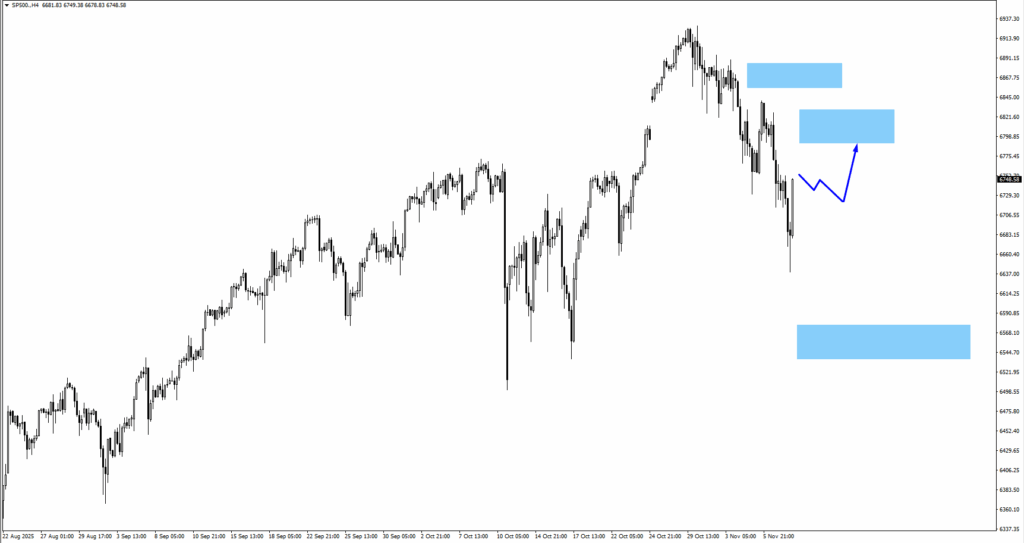

S&P 500 (SPX)

- The index extended gains after strong earnings, testing near-term resistance around 6810.

- Sustained strength above this level could open the way toward 6900, while initial support sits near 6640.

- Traders should watch CPI results for confirmation of sentiment direction.

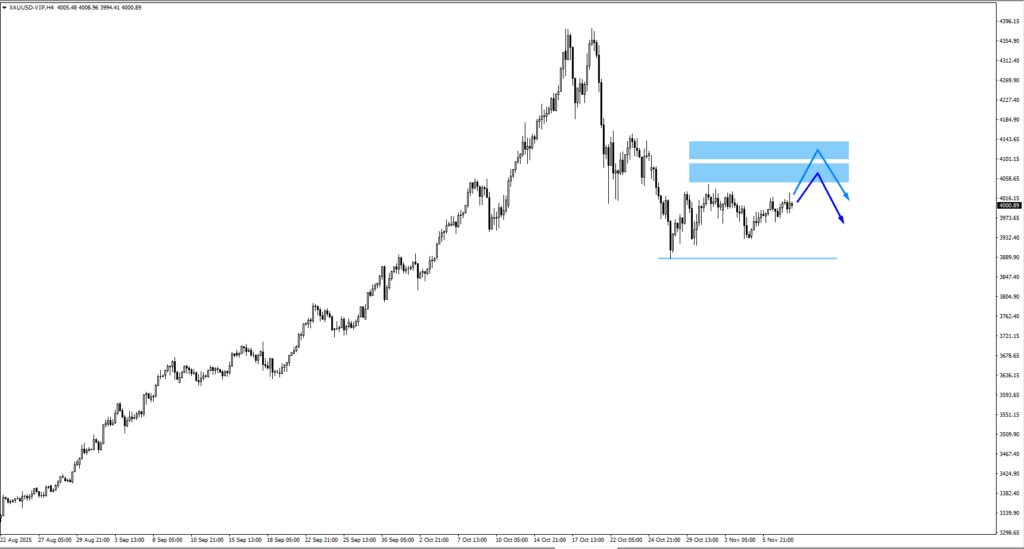

Gold (XAUUSD)

- Gold remains range-bound near $4,000, consolidating after last week’s rally.

- Bearish price action may emerge near $4,070 or $4,120.

- A weak CPI print could lift gold as the dollar softens.

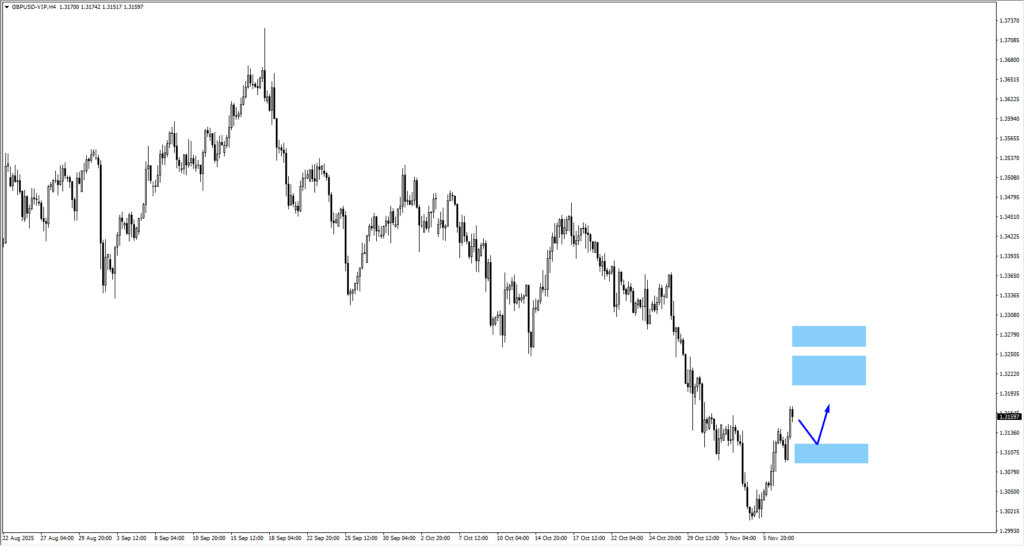

GBPUSD

- Cable traded above 1.3120, with potential consolidation around 1.3100.

- UK GDP and next week’s CPI could set the tone for the pound’s short-term bias.

- Bullish momentum holds if prices sustain above 1.3225.

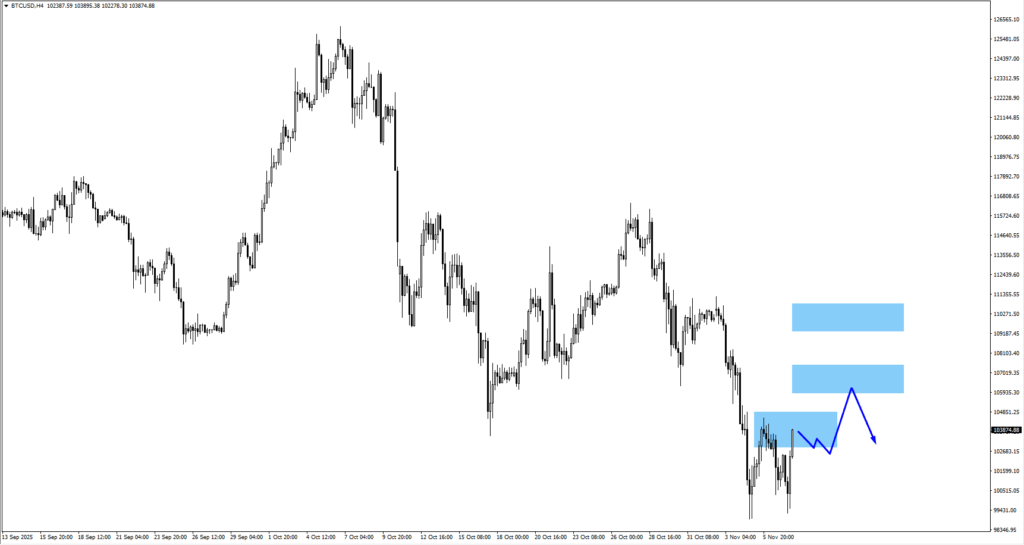

Bitcoin (BTCUSD)

- Bitcoin rebounded from 100,770, eyeing 104,552 resistance.

- A clean break above that level could lead to a correction before further upside.

- Watch for risk-on cues following CPI data for volatility spikes.

Market Snapshot

The S&P 500’s rally remains underpinned by strong Q3 earnings, but with valuations stretched and inflation data approaching, traders are entering a more cautious phase. The week’s CPI and PPI releases could determine whether optimism over profits can offset lingering rate concerns, or if elevated valuations begin to weigh on sentiment.

If inflation readings stay soft, risk appetite may hold steady into year-end, keeping tech and financials in favour. A hotter print, however, could shift the tone quickly, bringing the dollar back into focus and prompting investors to reassess equity exposure ahead of December’s policy meetings.