Overview

- The main theme is dollar resilience amid fading expectations of a December Federal Reserve rate cut.

- Traders will watch ISM manufacturing and services PMIs, as well as the Bank of England rate decision, for fresh direction.

- A rotation from growth to value and from euro/dollar pairs into commodity-linked currencies may unfold.

- RBA expected to hold rates at 3.6%, with policy tone watched for signs of regional divergence.

- Key data: ISM (3 Nov), RBA cash rate and JOLTS openings (4 Nov), BoE rate decision (6 Nov), US non-farm payrolls (8 Nov).

Markets face a week of hesitation rather than conviction.

The Federal Reserve’s late-October message changed the tone: a December rate cut is no longer a certainty.

Chair Powell stressed that policy will depend on incoming data; yet a federal government shutdown means much of that data isn’t even arriving.

Without clear visibility, the Fed is “driving in fog”, and traders are reassessing how quickly easing might resume.

The result: a conflicted dollar, cautious equities, and traders leaning toward safety until the fog clears.

The Fog Before the Cut

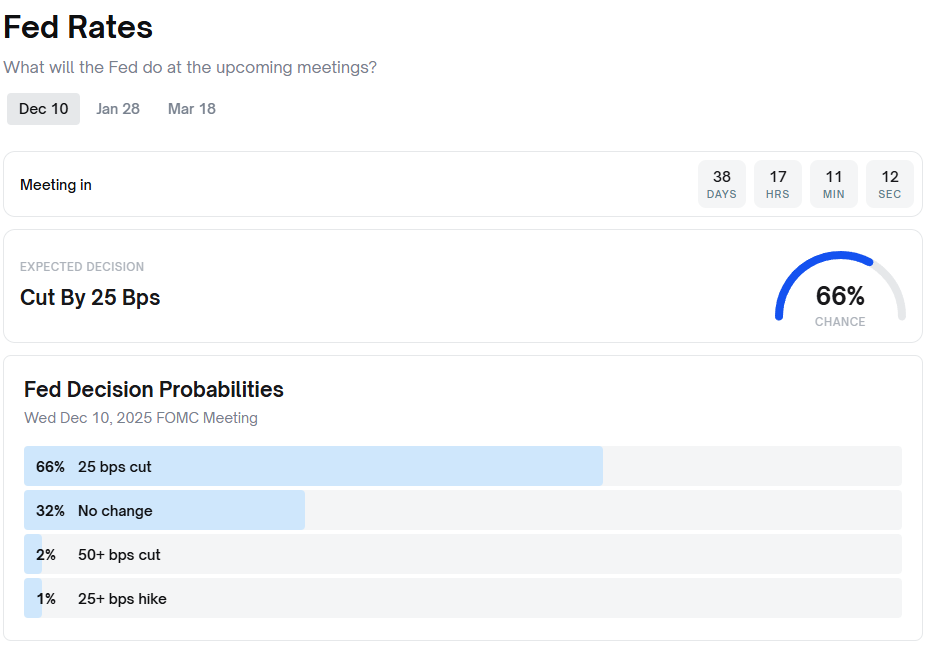

Before October’s FOMC meeting, futures markets were nearly unanimous in expecting a December rate cut.

After Powell’s remarks, the mood flipped. The CME FedWatch tool shows cut odds plunging from roughly 90% to 63%, while Polymarket odds echo a 66% probability of a quarter-point cut and 32% chance of no change.

In other words, the market still expects easing—but no longer trusts it.

This shift stems from Powell’s emphasis on divided policymaker views and the data blackout caused by the federal shutdown.

With no fresh economic numbers, policymakers are flying blind, and traders are hedging both sides of the trade.

Volatility pricing suggests markets are preparing for a slower, messier glidepath into December rather than a clean rate-cut narrative.

A Case for Patience

If inflation continues its downward slide, the Fed will have the cover to cut—but not the pressure.

The September CPI rose 3.0% y/y, up slightly from 2.9% due to energy prices, yet the underlying picture looks softer:

- Core CPI held steady at 0.3% m/m, consistent with a gradual slowdown.

- The shelter component—the single biggest driver of inflation—fell to 0.16% m/m, the lowest in over a year.

- More than 51% of CPI components are now deflating from their peaks, compared with a long-term average of 32%.

This breadth of disinflation suggests the fight against inflation is largely won.

Fed staff still projects core PCE to end the year near 3%, but the overall tone of price pressures has turned decisively lower.

The takeaway: inflation is cooling “like a rock”, yet the Fed remains wary of cutting too soon and risking a rebound.

From Euphoria to Hesitation

The market’s behaviour after Powell’s comments says it all.

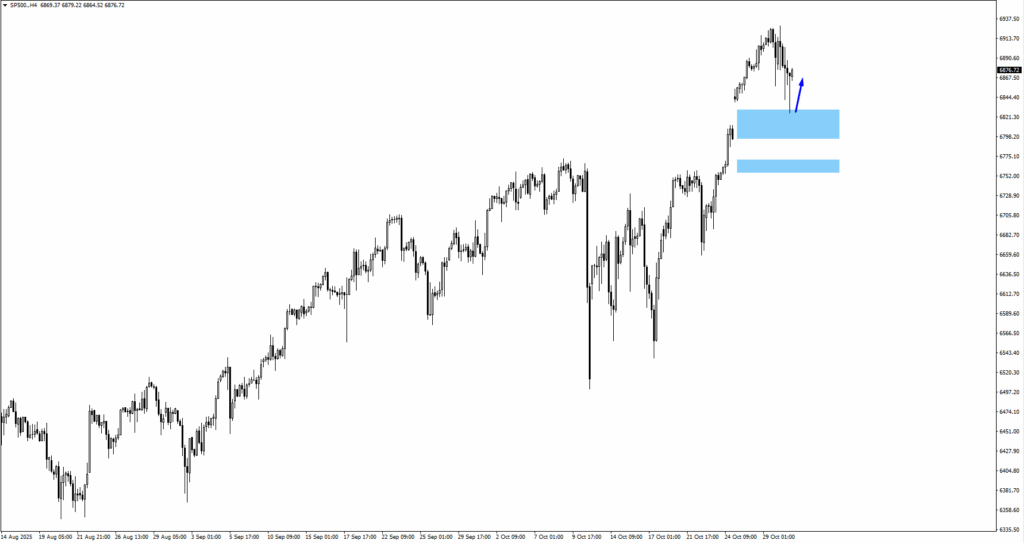

- Equities pulled back from recent highs as traders priced in fewer cuts and slower growth.

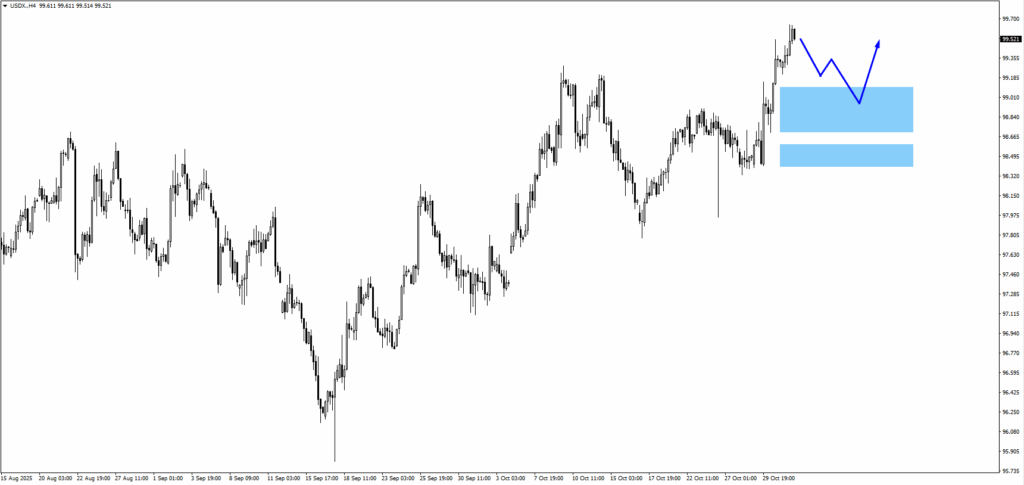

- The US Dollar Index (USDX) rebounded toward the 99.00–100.00 zone, reflecting a defensive bias.

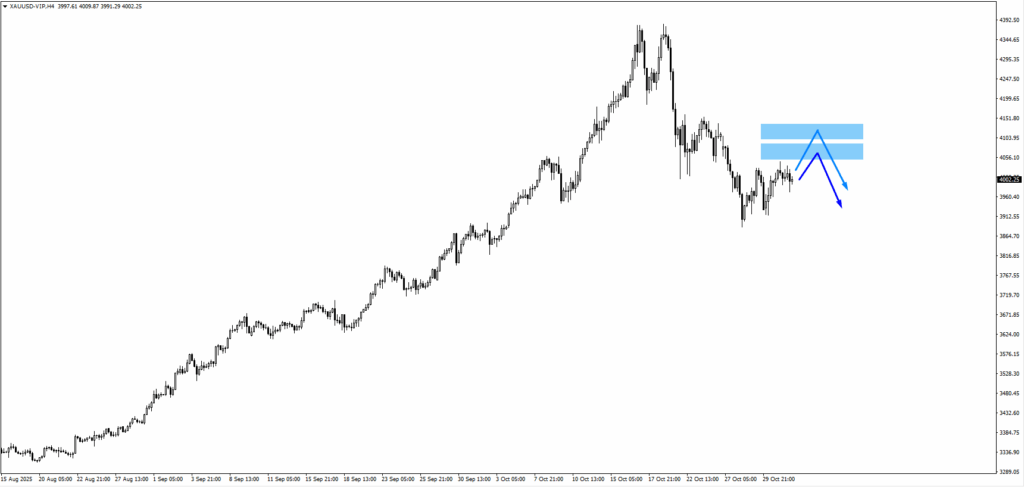

- Gold stalled near $4,070, trapped between softer inflation and a stronger dollar.

- Yields edged lower but not enough to trigger renewed equity momentum.

Meanwhile, on prediction platforms like Polymarket, the sharp decline in certainty mirrors broader investor sentiment—still leaning dovish but hedged aggressively.

The total wagering volume of over $9 million on the Fed’s December market shows how crucial this decision has become to global positioning.

Cautious Easing Ahead

The path forward likely depends less on one data print and more on how long the uncertainty lasts.

If the shutdown drags on beyond mid-November as current betting odds suggest, the Fed could enter December with incomplete data.

That scenario argues for a 25 bps cut as the base case, but with low conviction.

In essence, markets are confronting a split narrative:

- Macro data support a cut.

- Policy caution delays it.

- Risk assets drift sideways in the meantime.

Key Symbols to Watch

BTCUSD | XAUUSD | USDX | GBPUSD | SP500

Upcoming Events

| Date | Currency | Event | Forecast | Previous | Analyst Remarks |

| 3 Nov 2025 | USD | ISM Manufacturing PMI | 49.4 | 49.1 | A print above 50 would signal sector stabilisation and reinforce USD strength. |

| 4 Nov 2025 | AUD | RBA Cash Rate | 3.60% | 3.60% | The RBA is set to hold; tone on inflation and growth may guide AUD volatility. |

| 4 Nov 2025 | USD | JOLTS Job Openings | 7.21 M | 7.23 M | Persistent declines in openings would point to cooling labour demand and weigh on the dollar. |

| 5 Nov 2025 | USD | ISM Services PMI | 50.8 | 50 | Service-sector momentum remains crucial for growth outlook; above 51 favours USD rebound. |

| 6 Nov 2025 | GBP | BoE Official Bank Rate | 4.00% | 4.00% | No policy change expected; forward-guidance language will determine GBP bias. |

| 8 Nov 2025 | USD | Core PCE m/m (Tentative) | — | — | The Fed’s preferred inflation gauge; soft reading may revive December cut hopes. |

| 8 Nov 2025 | USD | Non-Farm Payrolls | — | — | Jobs and wage data will define rate-cut probability and short-term USD direction. |

| 8 Nov 2025 | USD | Unemployment Rate | — | — | Any uptick above 4 % could tilt sentiment dovish and pressure yields. |

For full view of upcoming economic events, check out VT Market’s Economic Calendar.

Key Movements of the Week

USDX (Dollar Index)

- Still supported by reduced rate-cut certainty; consolidation near 99.00.

- Watch 98.50 as short-term support; resistance at 100.20.

- Break above 100 could extend toward 100.75; reversal signals near 98.50.

Gold (XAUUSD)

- Stalled around $4,070 as traders balance cooling inflation with firmer yields.

- Resistance at $4,120; support near $3,930.

- Range-bound until clearer Fed direction.

SP500

- Pulled back after testing 6,950 as caution dominates.

- 6,750 support remains critical; 7,000 psychological barrier caps upside.

- Sensitive to shifts in rate-cut probabilities and shutdown headlines.

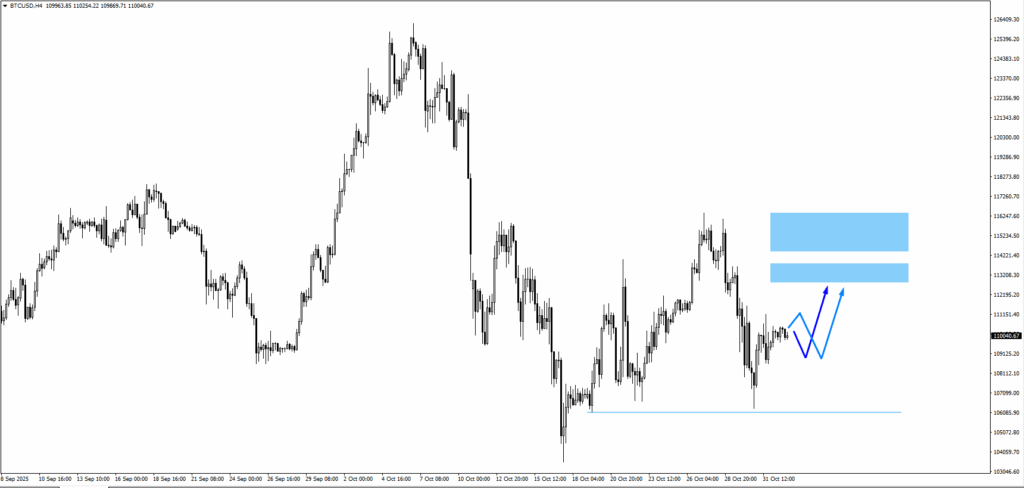

BTCUSD

- Consolidating above 106,000; upside targets 112,800–114,650 if risk stabilises.

- Break below 106,000 exposes 103,500.

- Volatility may pick up as liquidity thins into mid-month.

Market Snapshot

Markets have shifted from confidence to caution following Powell’s recent remarks, which underscored the Federal Reserve’s data-dependent stance.

Although inflation continues to ease across key sectors, the path forward for policy remains uncertain. Traders are now positioning for a possible rate cut in December, but with no clear signal from the Fed, the U.S. dollar has held steady and broader risk sentiment remains subdued.